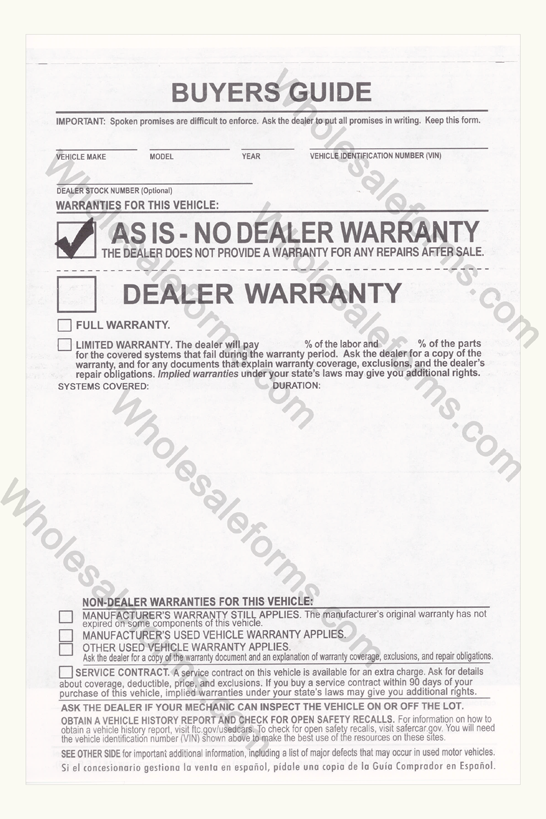

All about WEF Buyers Guide

2021 Buyers Guide by MD Publishing - issuu

The smart Trick of Buyer's Guides - Tape Op Magazine - Longform candid That Nobody is Discussing

Shopping for any kind of property owners insurance coverage can appear overwhelming. There's a great deal of insurance jargon tossed your method, and if you're a first-time homebuyer or haven't been through the procedure in a while, you may be lost when it familiarizes what protection you truly require. And though your mortgage lending institution may be pushing you to acquire home insurance coverage (and in some cases home mortgage insurance coverage) As Soon As Possible, putting in the time to get this choice right is crucial to avoiding headaches down the line.

Aluminum Extruder Buying Guide - AEC

So whether you're aiming to rapidly renew your insurance coverage or wish to change companies altogether, we have actually got you covered with our detailed guide to buying home insurance. Key takeaways: If you're buying home insurance for a new home purchase, make certain to get your house inspected sufficiently prior to getting protection.

Home insurance coverage costs an average of $1,200 annually, though this rate can fluctuate depending on place, protection needs and recommendations add ons. Buying Answers Shown Here is such an exciting experience. Filled with journeys with your realty representative, seeing great deals of prospective new homes and preparing eventual DIY projects.

The Ultimate Guide To Buyer's Guide: Endpoint Security - FireEye

(Rightfully so, with whatever that's going on!) However you do not wish to wait till it's far too late to discover out that your home appliances aren't covered or that you can't file a claim for a water backup that entirely soaks your very first floor. This is why when purchasing a home insurance policy for your new house, getting your home properly inspected is a must.

Doing background research study on the home's claim history, flooding zone and typical utility expense is likewise a terrific idea. That method, you can identify what insurance coverage riders you might need to contribute to your policy in addition to the average month-to-month expenses of preserving your brand-new home. Ask yourself concerns for a smarter buy No matter if you're renewing your policy for security upgrades or altering suppliers completely, asking the difficult concerns is crucial to supreme house defense.

Buyers Guide – Are You Creating Liability? - Arenson Law Group, PC

If your home is close to a station house or health center, you might have the ability to get a discount rate. Conversely, if your area is in a higher-risk area for natural disasters, you might need to pay for extra coverage. Smart home devices are all the rage lately, as they provide benefit and extra security with the touch of a button.